Three Things To Avoid When You File Bankruptcy - An Overview

If you recognize You cannot repay your debts, cease utilizing credit history. Usually, knowingly operating up credit cards before bankruptcy or having out funds improvements is taken into account fraud.

In these scenarios, if you'd presently filed for Chapter seven bankruptcy inside the prior eight decades, you wouldn't be entitled to another discharge.

It could appear to be counterintuitive, however you can Make contact with your creditors directly. This option is effective best early in the method before you decide to are too delinquent, but later you may negotiate right with the gathering company.

Your debts are reorganized, as well as a plan is about up to pay for them. You need to be in a position to maintain your household soon after Chapter thirteen bankruptcy assuming that fulfill the requirements with the repayment approach set up via the bankruptcy court docket.

There are two sorts of bankruptcy filings you are able to Choose between. A Chapter seven bankruptcy filing is in which you inquire the courtroom to totally discharge your debts, using any existing assets You will need to shell out out. A Chapter thirteen bankruptcy filing sets up a court-accredited payment decide to spend a small Component of That which you owe over the subsequent 3 to 5 several years. In each conditions, a bankruptcy penalty is placed on your credit rating report and stays on your own credit history record for as much find out here as 10 years—three a long time longer than most other penalties, including financial debt settlement.

If you are productive, you can avoid acquiring bankruptcy stated on your own credit rating report, while also being free from a financial debt.

Based on the kind of bankruptcy you file for, you might have to attend as many as 4 several years just before applying for a house financial loan. This waiting around time period is shortened to 2 to three yrs for government-backed home loan loans, and other people visit site who file for Chapter thirteen (as opposed to Chapter 7) bankruptcy may only have to watch for 1 to 2 yrs.

Lowering your interest charge could have a big effect on your ability to repay financial debt, especially if you’re shelling out off charge cards or higher-fascination loans.

Do you realize Nolo has designed the legislation available for over fifty several years? It's accurate, and we would like to ensure you obtain what you may need. Under, you will find a lot more content articles describing how bankruptcy operates. Read More Here And remember that our bankruptcy homepage is the best spot to begin When you've got other thoughts!

You could possibly take out a home fairness financial loan or refinance the home loan when you have your house and possess good fairness—the value of your home is larger than your remaining house loan.

Filing for bankruptcy requires more than paperwork. Avoid popular faults and make certain a smooth check my reference bankruptcy by Understanding what not to do in advance of filing for Chapter 7 or Chapter 13 bankruptcy.

Several negative elements make this a risky debt-aid possibility, however, if it retains you from needing to file bankruptcy, it’s possibly worthwhile.

Other debts cannot be discharged. This includes back alimony or boy or girl assist, debts check that owed to the government, judgments connected to DUI accidents, tax debts, and administrative expenditures or restitution

With no subpoena, voluntary compliance around the component of one's Online Assistance Company, or more data from the third party, information saved or retrieved for this intent on your own can not typically be used to determine you.

Mason Gamble Then & Now!

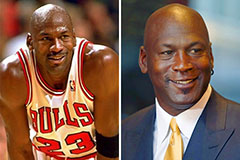

Mason Gamble Then & Now! Michael Jordan Then & Now!

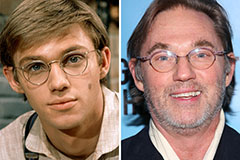

Michael Jordan Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!