You might have the opportunity to hire lawful representation for the duration of any of those proceedings in case you don’t desire to go it alone. When you’re productive along with the courtroom denies your creditor’s objection to discharge, then that debt is going to be erased by your personal bankruptcy discharge.

Our crew features financial debt professionals and engineers who care deeply about making the financial program available to Every person. We've got planet-class funders that come with the U.S. government, former Google CEO Eric Schmidt, and primary foundations.

The court necessitates filers with significant disposable income to pay for some or all of your credit card debt by way of a Chapter 13 repayment strategy. Plus, a individual bankruptcy filing will keep on being on your credit report for 7 to ten decades. So it is best to look at all offered alternatives to start with.

We think that favourable financial adjust starts with one option. Equifax performs an important purpose in making People opportunities doable. The operate we do is supported by solid environmental, social and governance tactics having a commitment to fostering an inclusive and diverse workplace.

When the intention of reaffirming a credit card personal debt is to help keep an account open up after bankruptcy, there's a fantastic probability it will not function simply because, as pointed out over, there is a fantastic likelihood the issuer will shut it anyway.

Take into consideration dealing read this article with a certified credit counselor to devise a sensible price range, set achievable money management goals, and build a lengthy-term approach for rebuilding your credit.

Filing for individual bankruptcy may even put a halt to foreclosure or legal steps from you, and it stops creditors from contacting and demanding payment. This "respiratory Room" is Among the most sought after advantages of filing personal bankruptcy.

There are rare circumstances through which you could possibly keep a credit card after a personal bankruptcy, but that click to find out more choice mainly hinges to the procedures of one's credit card issuer.

When you are going through a lawsuit or even the credit card corporation just isn't prepared to work along with you, it'd be time to look at your individual bankruptcy choices.

Borrowing funds before your personal bankruptcy filing can jeopardize your scenario and, even worse, set you in danger possessing your residence repossessed or foreclosed on.

Wellness & Wellness We support employees’ physical and psychological nicely-getting by way of resources and sources that link will help them Stay their best.

A funds progress is a short-time why not look here period personal loan that sometimes includes a higher desire charge. Hard cash innovations occur in several forms. A funds advance may be taken in opposition to the obtainable balance on the credit card.

If a debt is usually eradicated in bankruptcy can also depend upon if the credit card debt is secured or unsecured. Secured debts are backed by "collateral" more tips here residence. Examples of secured debts consist of a home finance loan or car or truck financial loan. Typically, should you default on a secured bank loan, the creditor might take the "collateral" (e.

When you understand that you’re gonna file individual bankruptcy, it’s time to stop using your credit cards. Preferably, you stop building new costs a few months before filing. Not surprisingly, if You must file immediately, you might not contain the time to attend.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Shaun Weiss Then & Now!

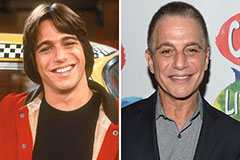

Shaun Weiss Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now!